- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

What is a dual-header bill of lading?

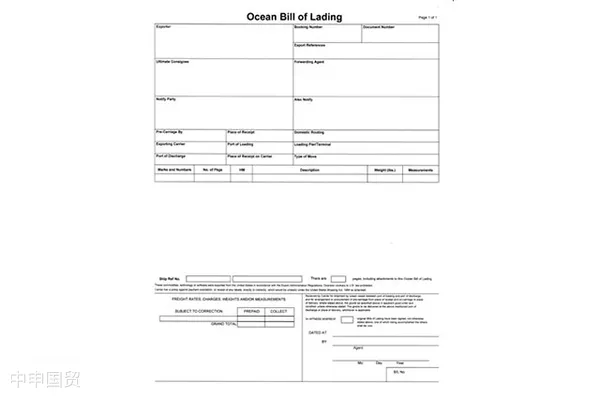

In international trade, the Bill of Lading serves as a document of title for goods, recording key information such as the Shipper and Consignee.Double House Bill of LadingIt refers to the display of two company names simultaneously in the Shipper or Consignee field of the bill of lading, typically appearing in forms such as "O/B" (on behalf of) or "C/O" (care of). This practice is common in trade scenarios involving intermediaries, aiming to meet specific requirements for bank payments, trade contracts, or ownership of goods.

Why is a dual heading necessary?

In certain trade scenarios, banks or trade contracts may require the bill of lading to display the name of a specific company to ensure clarity regarding payment or ownership of the goods. For example, intermediary company B needs to pay the exporter company A, but the bank insists that the bill of lading must include the name of company B before releasing the funds. In such cases, using a dual header on the bill of lading (such as "A O/B B Company") can meet the bank's requirements while maintaining company A's identity as the actual exporter.

How to display dual headers on a bill of lading?

According to trade requirements, dual headers can appear in either the Shipper or Consignee fields. Below are two common methods:

1. Shipper's dual heading: A O/B B Company

- Applicable scenarios: Company B, acting as an intermediary, actually makes the payment to Company A, and the bank requires the bill of lading to display the name of Company B.

- Operation Method: Fill in the "Shipper" field on the bill of lading with "Company A O/B Company B," indicating that Company A is shipping on behalf of Company B.

- Advantages: Clarify the involvement of Company B to facilitate the bank's verification of payment information.

2. Consignee dual heading: C/O B Company

- Applicable scenarios: Company B hopes that upon the arrival of the goods at the destination port, Company C will act on its behalf to handle the customs clearance procedures.

- Operation Method: In the Consignee field of the bill of lading, fill in "Company C O/B Company B," indicating that Company C is receiving the goods on behalf of Company B.

- Advantages: Ensure the ownership of the goods for Company B, while Company C is responsible for customs clearance.

- Trade structure: Company A (Exporter) → Company B (Intermediary, Payer) → Company C (Importer).

- Requirements: Company B must have its name displayed on the bill of lading to facilitate the bank's release of payment to Company A.

- Solutions: In the Shipper field of the bill of lading, enter "Company A O/B Company B" to ensure that the name of Company B appears on the bill of lading, meeting the bank's payment requirements.

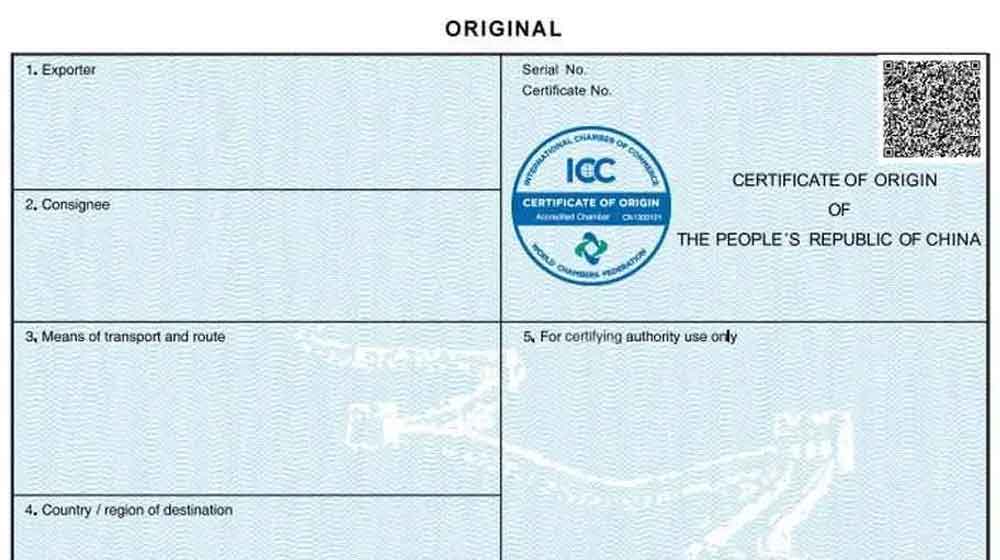

If the Certificate of Origin also needs to display a dual heading, you can fill in "A O/B B Company" in the Shipper field as well. If the China Council for the Promotion of International Trade or the Commodity Inspection Bureau cannot process a dual-heading Certificate of Origin, you may add a note below the Goods Description stating "Shipper: B Company Name" to meet the relevant requirements.

Precautions

Selection suggestions: Based on the actual situation, Company B may be the intermediary and needs to pay Company A for the goods. Additionally, the bank requires the bill of lading to display Company B's name for payment purposes. It is recommended to useShipper dual heading, namely "A O/B B Company," to meet the bank's foreign payment conditions.

- Communicate with the bank: Before operating a dual-header bill of lading, always confirm the specific requirements with the bank to ensure that the format and content of the bill of lading meet the conditions for foreign exchange payment.

- Coordinate with the freight forwarder.: Notify the freight forwarder in advance about the bill of lading title requirements to avoid errors discovered after issuance, which may affect cargo release.

- Negotiate with trading partners: Fully communicate with Company A and Company C to ensure that all parties have no objections to the bill of lading title, thereby avoiding subsequent disputes.

- L/Cbusiness based on this: If a letter of credit is involved, the consignee on the bill of lading must be filled out strictly in accordance with the requirements of the letter of credit, and must not be altered arbitrarily.

Conclusion: Dual-header bill of lading, simplifying complexity.

A bill of lading with dual headers may seem complex, but it is actually a flexible tool in trade practice. By appropriately setting up dual headers for the Shipper or Consignee, it not only meets the bank's payment requirements but also ensures clarity in the ownership of the goods.foreign tradeWhen handling operations, beginners need to fully communicate with all parties involved and pay close attention to details in order to successfully complete export transactions. Hopefully, this article will help demystify the "dual-header bill of lading" for you, making your foreign trade journey smoother!

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912